The only two variables I use when building trading systems are sentiment and price. I consider the non-volume-based implied volatility indices (VIX is one of them) as the only pure sentiment indicators for equities.

The TCs on the hourly VIX.

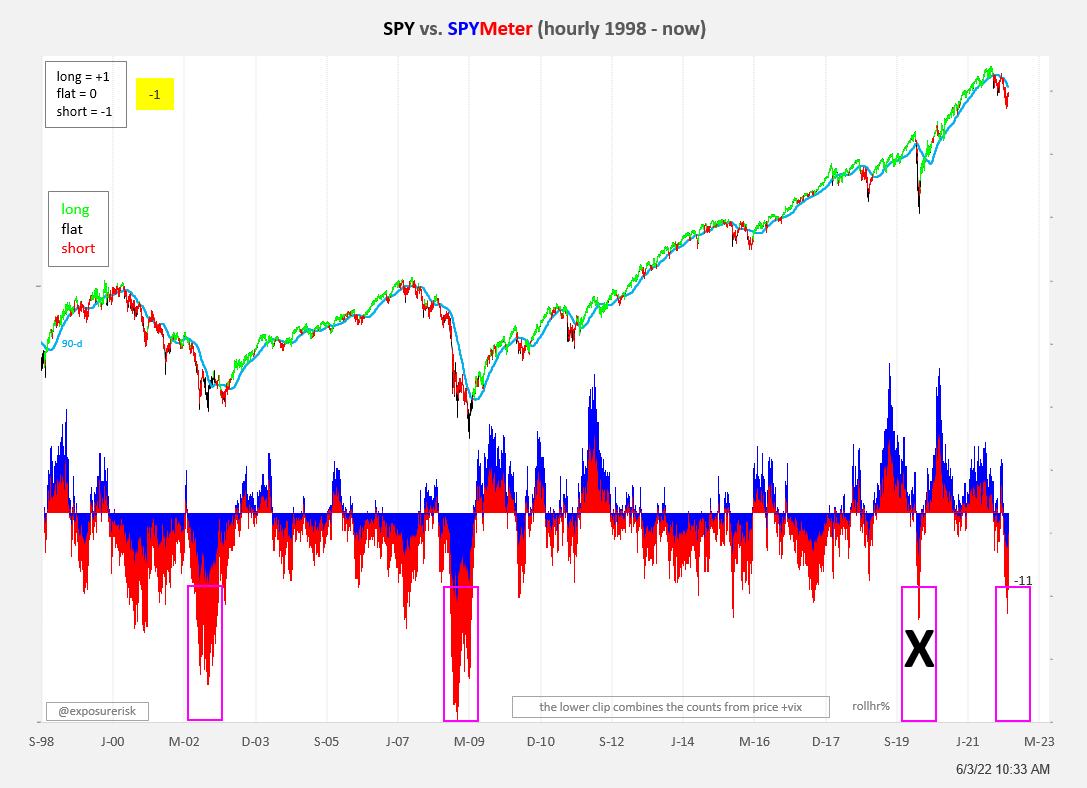

The hourly SPYMeter adds the TCs of the hourly VIX + SPY.

The TCs applied to the hourly (VIX-Realized Vol) spread.

The daily brother to the TCs applied to the VIX.

The market volatility composite below (1986 - now) is a trading model that combines the VIX, VXN, and realized volatility.